modified business tax refund

The TCJA modified existing tax law on excess business losses by limiting losses from all types of business for noncorporate taxpayers. The Department is developing a plan to reduce the Modified Business Tax rate for quarters.

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

Effective July 1 2019 the tax rate changes to 1853 from 20.

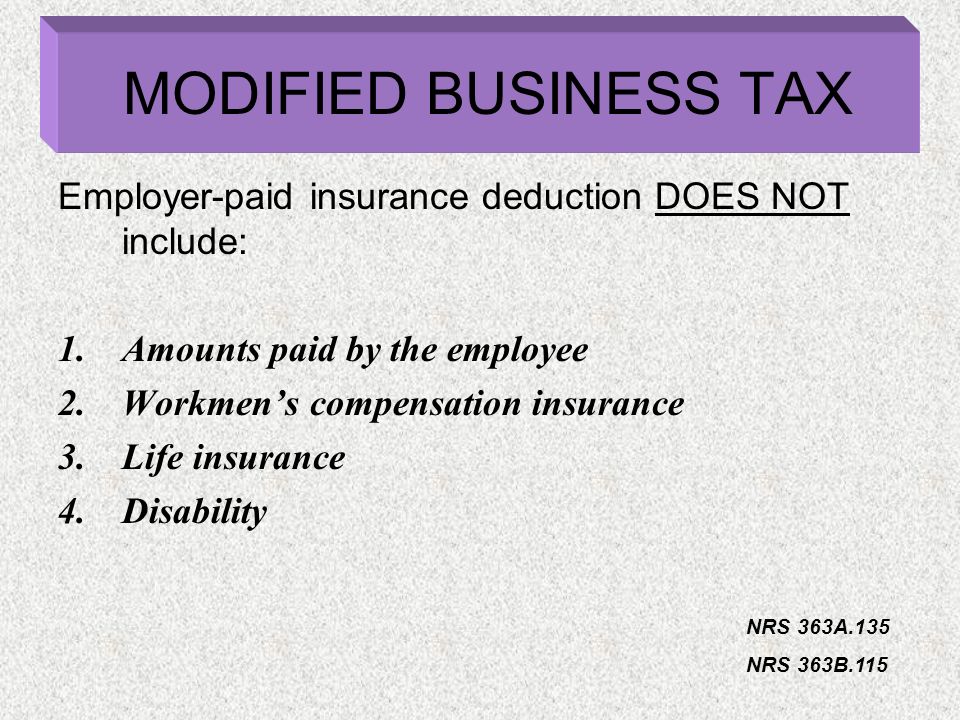

. Modified Business Tax Return-Financial Institutions 7-1-19 to Current This is the standard quarterly return for reporting the Modified Business Tax for Financial Institutions as defined by NRS 360A050. There are no changes to the Commerce Tax credit. The DOT has been ordered to refund to businesses the excess tax collected plus interest from the date of collection.

Nevada Revised Statute 363B120 provides an abatement of the Modified Business Tax for qualifying businesses. Qualifying employers are able to apply for an abatement of 50 percent of the tax due during the initial four years of its operations. The CARES Act allowed these credits for wages paid after March 12 2020 and before January.

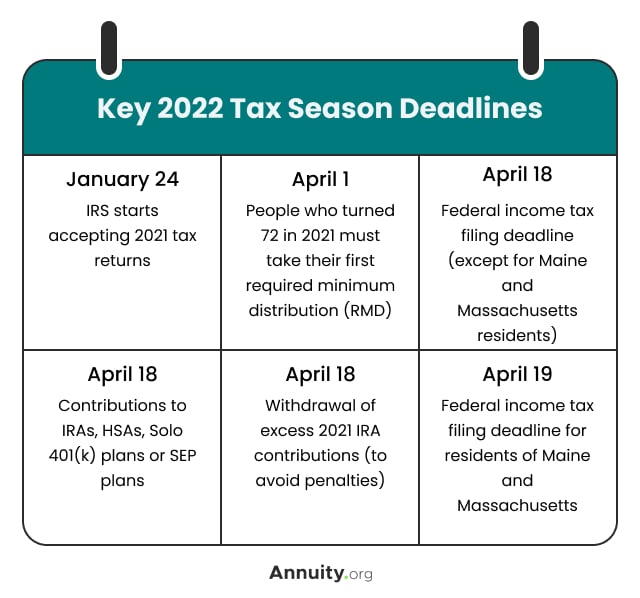

Treasury IRS provide additional guidance to employers claiming the employee retention credit including for the third and fourth quarters of 2021. The next round of refunds is scheduled for September. If you are due a refund you have three years.

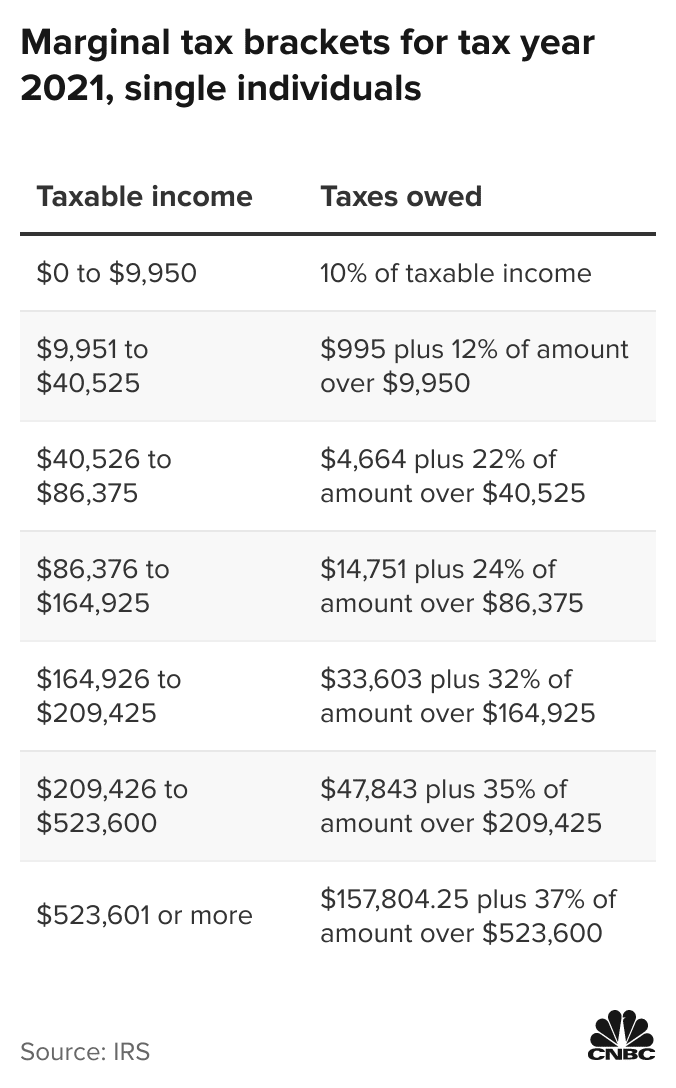

The MBT rates have remained the same 1475 on taxable wages exceeding 50000 annually for most businesses 2 for financial institutions and mining companies and were not reduced to 1378 and 1853 respectively. Employer paid health care costs paid this calendar quarter. If you must pay more taxes file the amended return as soon as possible to avoid fines and penalties.

Total Gross Wages - Enter the total amount of all gross wages and reported tips paid this calendar quarter. Schedule C is included in your personal tax return Form 1040 or 1040-SR so to amend your business taxes you must amend your entire tax return. INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - FINANCIAL BUSINESSES ONLY General Businesses need to use the form developed specifically for them TXR-02005 Line 1.

According to media reports the legal dispute over Senate Bill 551 emerged when the Democrat-led Senate passed a bill in the 2019 session that extended a higher rate for the modified business tax payroll tax that was otherwise set to revert to a lower level. On May 13 2021 the Nevada Supreme Court upheld a decision that the biennial Modified Business Tax rate adjustment was unconstitutional and ordered the Nevada Department of Taxation to refund any overpayment of the Modified Business Tax plus interest to businesses. If the change in Schedule C changes your business net income profit amount it may change the rest of your tax return including possibly your self-employment tax amount.

New law extends COVID tax credit for employers who keep workers on payroll. You will need to use Form 1040-X to do this. IRS provides guidance for employers claiming the Employee Retention Credit for first two quarters of 2021.

Under the Coronavirus Aid Relief and Economic Security Act CARES Act as originally enacted March 27 2020 the Employee Retention Credit is a refundable tax credit against certain employment taxes equal to 50 of the qualified wages an eligible employer pays to employees. An excess business loss is the amount by which the total deductions from all trades or businesses exceed a taxpayers total gross income and gains from those trades or businesses plus 250000 or 500000 for a joint return. Filing an amended business tax return should be done as soon as you discover the error.

A partial abatement of the business tax during the initial period of operation is available.

Common Irs Audit Triggers Bloomberg Tax

Americans Should Be Prepared For A Smaller Tax Refund Next Year

Employee Retention Tax Credit Significantly Modified And Expanded For Businesses Shindelrock

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

Form 8962 Premium Tax Credit Definition

Your Tax Refund May Be Late The Irs Just Explained Why The Washington Post

Ask The Advisors Basic Tax Academy State Of Nevada Department Of Taxation Ppt Download

Tax Filing 2021 Performance Underscores Need For Irs To Address Persistent Challenges U S Gao

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Don T Count On That Tax Refund Yet Why It May Be Smaller This Year

Avoid 6 Mistakes That Will Delay Your Irs Tax Refund

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)